The Australian Childcare Alliance (ACA) NSW has provided these highlights for members following last night’s Federal Budget 2020. ACA NSW strongly recommends that members consult their accountants, business and tax advisors to ensure their full understanding.

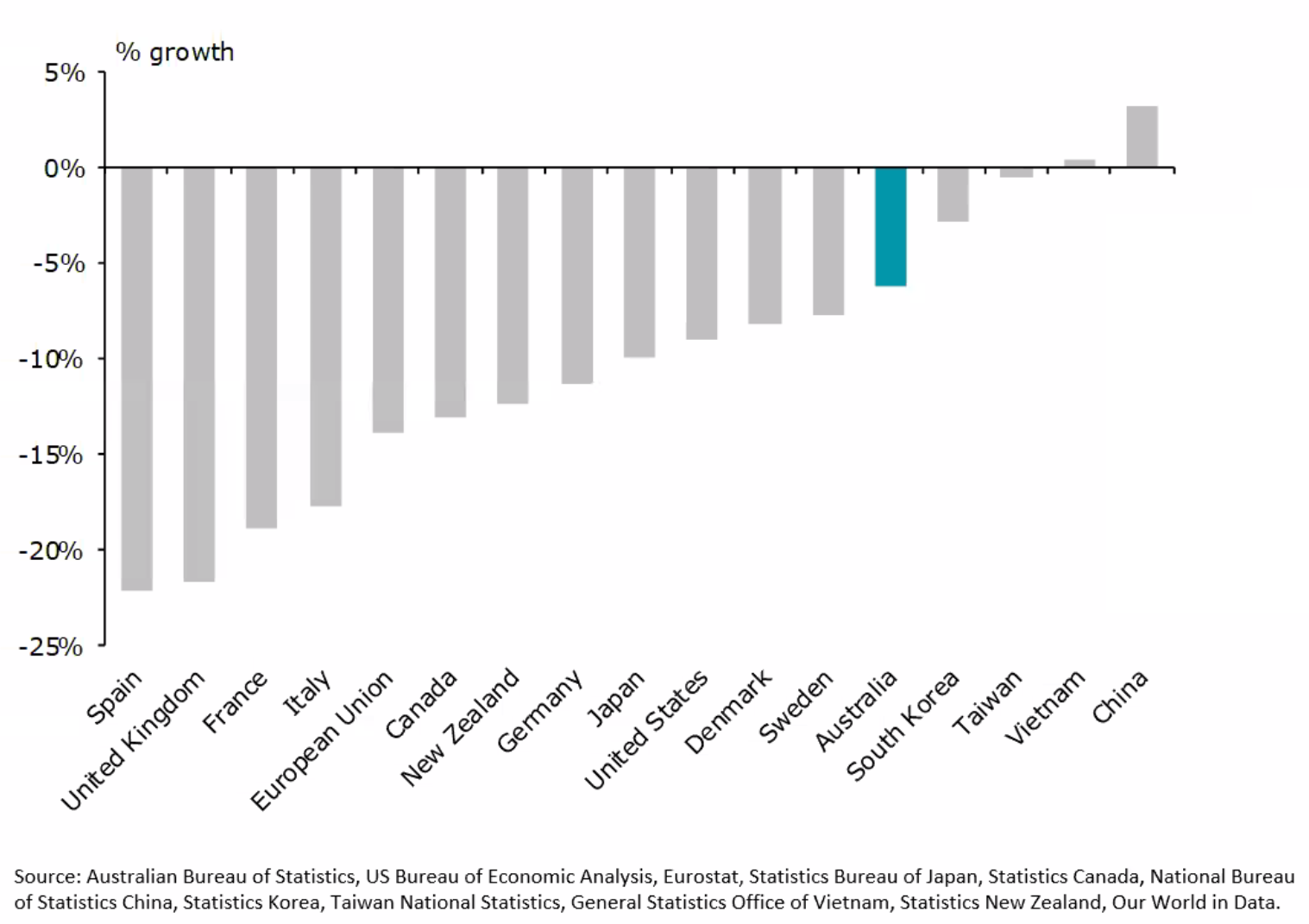

Despite the hardship and still upcoming challenges, compared to most other nations, especially those in the western hemisphere, there is so much that Australians can be somewhat proud of during this global COVID-19 pandemic in terms of health and economic aspects.

Due to COVID-19, the International Monetary Fund (IMF) estimated that Australia’s gross domestic product (GDP) for FY2019/2020 was -6.67%. But the IMF also predicts Australia's GDP to be +6.11% for FY2020/2021. This was also the view of the Federal Government in its Budget 2020 – ie predicting a significant bounce back particularly next year.

The following lists the highlights of last night’s Federal Budget 2020 that members should consider:

- The Low and Middle Income Tax Offset (LMITO) (for incomes up to $90,000) is extended for another year provides a reduction of tax of up to $1,080 for individuals.

- The lowering of personal income tax rates to be in effect from 1 July 2020. Hence services need to anticipate they may be providing tax refunds (ie credits) to their employees. (NOTE: Until the Federal Parliament passes its legislation, the timing of this may be unclear.)

- JobMaker Hiring Credit to employers hiring new employees (ie $100 per week for new employees aged 30-35 years old, and $200 per week for new employees aged 16-29 years old) who begin employment between 7 October 2020 and 6 October 2021, who work at least 20 hours per week on average, who have received JobSeeker/Youth Allowance/Parenting Payment for at least one month within 3 months prior of being hired. Services will have to demonstrate an increase in the total employee headcount from the reference date of 30 September 2020, and the payroll for the reporting period as compared to the three months to 30 September 2020.

- Eligible services can carry-back losses made in FY2019/2020, FY2020/2021 and 2021/2022 to a prior financial year’s income tax liability up to FY2018/2019.

- Employers can receive subsidies for 50% of the wages of a new or recommencing apprentice or trainee to the value of $7,000 per quarter until 30 September 2021 under the Boosting Apprenticeships Commencements’ Subsidies.

- The amendment of the small business entity turnover threshold from $10 million to $50 million will see 10 small business tax concessions extended to medium-sized businesses. This is in addition to a number of fringe benefits tax changes and COVID-19 measures specifically tailored towards small businesses.

- Temporary full expensing will be available until 30 June 2022 for 99.9% of businesses. This will allow services to deduct the full cost of eligible depreciable assets of any value in the year they are first used or installed ready for use. The cost of improvements made during this period to existing eligible depreciable assets can also be fully deducted.

ACA NSW members may also be interested to know that:

- the Paid Parental Leave (PPL) work test period will be temporarily extended to 20 months (600 days) to ensure that parents whose employment has been impacted by COVID-19 are supported and that women can remain connected to the workforce; and

- the Federal Government had also announced temporary changes to the creditors' statutory demand and insolvent trading laws extended to 31 December 2020.

For any further information/clarification, ACA NSW urges members to consult their accountants, business and tax advisors. That said, ACA NSW may be able to assist by contacting 1300 556 330 or nsw@childcarealliance.org.au.

PUBLISHED: 7 OCTOBER 2020